The pandemic doesn’t stop the European e-bus market: +22% in 2020

In the year of Covid, the battery-electric bus market increased of 22% in Western Europe (with the addition of Poland). 2,062 e-buses (trolleybuses excluded) were registered between 1 January and 31 December 2020, vs the 1,685 that debuted in 2019 (that, it is worth remembering, it has been a truly record year with tripling figures […]

In the year of Covid, the battery-electric bus market increased of 22% in Western Europe (with the addition of Poland). 2,062 e-buses (trolleybuses excluded) were registered between 1 January and 31 December 2020, vs the 1,685 that debuted in 2019 (that, it is worth remembering, it has been a truly record year with tripling figures on 2018). As of today, in the area, 5,087 e-buses have been delivered since 2012. What is interesting, nearly 75% of them have been handed over in 2019 and 2020.

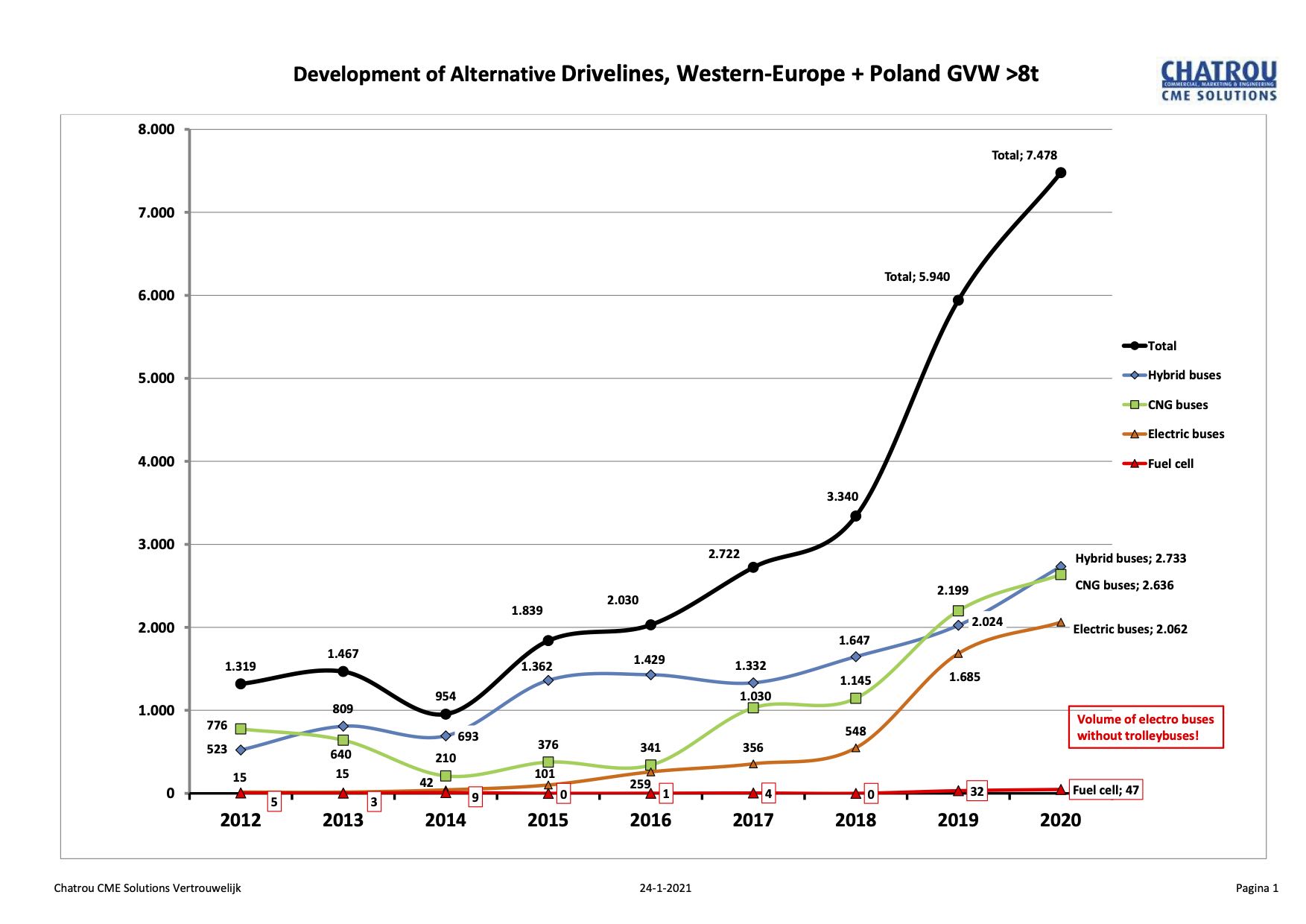

All in all, according to data collected and analyzed by Chatrou CME Solutions, 53% of the city buses registered in 2020 had an alternative driveline. In 2019 this was 39,6%. The share of battery-electric buses on the total volumes of Class I buses in 2020 was 15%, coming from nearly 12% in 2019.

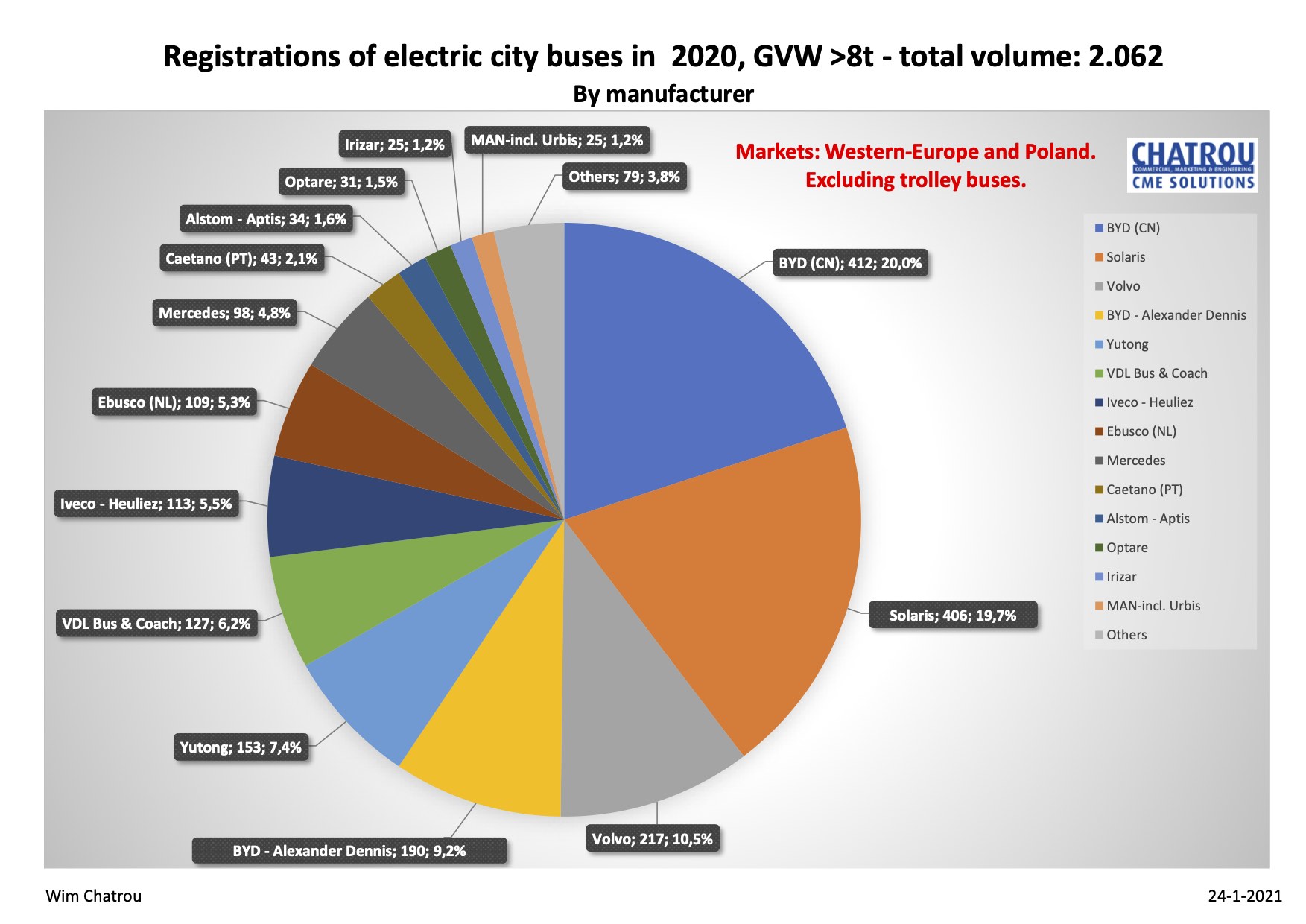

Battery-electric bus market, BYD and Solaris leading

BYD and Solaris are market leaders with a total of 412 and 406 electric buses respectively (they both have around 20% market share). The Polish brand was first at the end of Q3 2020, but BYD performed a come back in Q4 mostly due to the 246 e-buses delivered in the Netherlands. The last quarter has been crucial: 50% of the e-buses (1,018) were registered between October and December.

The two market leaders are followed by Volvo with 217 (with heavy incidence of the Gothenburg supply of 145 vehicles) and Alexander Dennis/BYD with 190 electric buses. BYD, Solaris and Volvo together cover half of the electric bus market.

Looking at the whole pie of the battery-electric buses delivered between 2012 and 2020, BYD is now market leader with a total of 819 electric buses and a market-share of 16,%. VDL is a close follower with a total of 791 buses (15,5%).

Alternative drive buses takes over half of the market

As mentioned above, over half (precisely 53%) of the city buses registered in 2020 had an alternative driveline. In 2019 this was 39.6%.

Focusing on the alternative driveline buses out of the battery-electric boundaries, hybrid buses saw an interesting increase (2,733 units, +35% on 2019). A trend pulled by mild hybrid application which are gaining ground in several markets.

CNG buses also registered a growth of 20% compared to 2019 volumes. The consulting firm points out that «What is remarkable as well is the growth, especially of CNG engines, in the Intercity and even the coach segment. Of the total of 2,636 CNG buses, 413 were in these segments (majority were Iveco Crossways)».

Interesting developments occurred also in the fuel cell bus sector, with 47 deliveries in 2020, growing from the 32 in 2019. And this year we expect a significant ramp up (although general volumes are still residual).